Business

The UK Economy at a Crossroads in 2026 Post Inflation Recovery

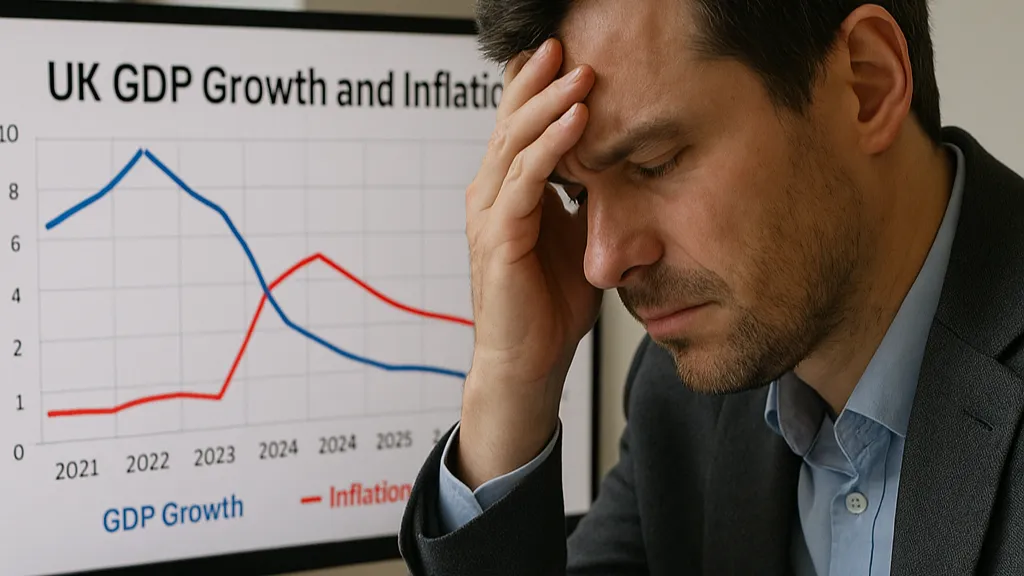

The United Kingdom enters 2026 at a critical point in its post-inflation recovery, balancing moderate economic expansion with deep structural reforms. After two years of tight monetary policy, the economy shows signs of resilience, with GDP growth projected between 1.3 and 1.6 percent. However, policymakers caution that underlying weaknesses in productivity, investment, and trade remain unresolved.

The Office for National Statistics recently reported that inflation has returned to the Bank of England’s 2 percent target for the first time since 2021, restoring a sense of stability after years of volatility. Yet, rising global energy costs and fluctuating commodity prices continue to pose risks to medium-term growth.

Fiscal Policy Focuses on Investment and Household Relief

The government’s latest fiscal plan places emphasis on targeted investment and cost-of-living support. The Treasury has prioritized infrastructure, digital innovation, and regional development projects to stimulate domestic demand and reduce inequality across the country.

Public spending, however, remains constrained by fiscal consolidation goals introduced after record borrowing during the pandemic. Analysts at the Institute for Fiscal Studies warn that maintaining both fiscal discipline and investment momentum will be one of the government’s most difficult balancing acts.

Household consumption has started to rebound as real incomes improve, though wage growth remains uneven across sectors. Retail data suggests that consumers are still cautious, with discretionary spending rising slowly despite lower inflation.

Monetary Policy Eases but Uncertainty Persists

The Bank of England’s decision to pause interest rate increases marks a turning point in the UK’s monetary trajectory. Governor Andrew Bailey indicated that further rate cuts could be possible if inflation remains subdued. Financial markets have reacted positively, with the pound stabilizing against major currencies and gilt yields declining modestly.

However, the central bank continues to warn against premature optimism. Global monetary tightening by other major economies, especially the United States and the European Central Bank, could limit the scope of UK easing.

Economists suggest that while lower rates may support business investment, long-term confidence will depend on supply-side reforms and improved productivity performance.

Business Investment and Trade Outlook for 2026

Private investment has gradually recovered as borrowing costs fall, with particular strength in green energy, advanced manufacturing, and digital services. The Department for Business and Trade expects foreign direct investment inflows to rise by 8 percent in 2026, supported by new bilateral trade arrangements and financial sector resilience.

Exports, however, continue to face friction due to post-Brexit regulatory divergence. Despite modest improvements in customs procedures, many small and medium-sized firms remain cautious about cross-border expansion. The government’s push for trade diversification toward Asia and the Middle East is yielding early progress, though the European Union remains the UK’s largest trading partner.

Energy Transition and Green Growth Opportunities

As part of its net-zero commitment, the UK government has accelerated its clean energy strategy to enhance energy security and meet climate goals. The transition to renewable sources has already generated significant investment in offshore wind, nuclear power, and hydrogen production.

Analysts view green infrastructure as both an economic and strategic priority. By 2026, renewable capacity is expected to cover more than 50 percent of national energy demand. The government’s emphasis on sustainable finance also supports London’s position as a global hub for green bonds and environmental investments.

Labour Market Stability and AI Integration

The UK labour market remains relatively tight, with unemployment below 4.5 percent, but automation and demographic changes are reshaping employment trends. Sectors such as logistics, healthcare, and financial services are increasingly adopting AI-driven systems, improving productivity while raising concerns about job displacement.

The government has announced workforce reskilling programs and incentives for companies to train employees in digital and technical skills. These efforts are part of a broader strategy to ensure that economic modernization does not widen social or regional disparities.

Regional Development and Infrastructure Expansion

Regional disparities continue to challenge national cohesion. Northern England, Wales, and parts of Scotland lag behind London and the South East in income and productivity. The Levelling Up agenda aims to address these gaps through investment in transport, education, and local enterprise zones.

Major projects such as the Northern Powerhouse Rail and renewable energy clusters in the North Sea are expected to support inclusive growth. International investors have also shown increased interest in logistics hubs and technology parks outside the capital.

Global Factors and Policy Coordination

The global economic environment remains uncertain as geopolitical tensions and supply chain disruptions persist. The UK’s economic strategy now relies on maintaining policy coherence between fiscal, monetary, and trade measures. Coordination between the Treasury, the Bank of England, and regional authorities will be critical to sustaining recovery momentum.

Observers note that the UK’s position as a mid-sized, globally connected economy demands agility in responding to shifts in trade and technology. The coming year will test the effectiveness of reforms aimed at rebuilding resilience and competitiveness in a rapidly changing world economy.

Outlook for 2026 and Beyond

As 2026 unfolds, the UK economy appears more stable yet still vulnerable to external shocks. The combination of steady growth, improved inflation control, and stronger investment flows points toward gradual normalization.

Policymakers face the dual challenge of sustaining growth while preparing for future disruptions in technology, climate, and global finance. Whether the UK can turn this period of recovery into long-term transformation will define its economic trajectory for the remainder of the decade.