Business

Q4 2025 London Stock Exchange Volume Surges Amid Global Volatility

Introduction

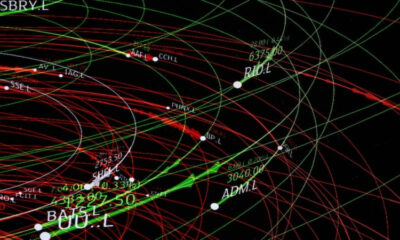

As 2025 enters its final quarter, the London Stock Exchange (LSE) has experienced a sharp surge in trading volumes, driven by heightened global market volatility and investor repositioning. Data from exchange monitors indicate that average daily trading activity has risen nearly 18 percent compared to the previous quarter. The rise reflects a combination of global economic uncertainty, fluctuating interest rate expectations, and renewed investor appetite for defensive sectors.

The London market, long regarded as a bellwether for global capital flows, is once again under the spotlight. While short-term volatility poses challenges, analysts suggest it also presents opportunities for active traders and portfolio managers who can navigate the turbulence.

Rising Trading Volumes and Market Drivers

The increase in trading volume is linked to several interconnected factors. First, international investors have re-entered UK equities following a period of relative underperformance earlier in the year. With inflation moderating and the Bank of England signaling a potential shift toward a neutral rate stance, investors are rebalancing portfolios toward equities that appear undervalued relative to global peers.

Second, heightened geopolitical uncertainty has contributed to significant fluctuations in currency and commodity markets. Events in Asia and the United States have triggered short-term risk-off movements, driving both institutional and retail traders to increase hedging activity on the London exchange. Financial instruments tied to energy, defense, and infrastructure have seen particularly heavy turnover.

The LSE’s derivatives and exchange-traded fund (ETF) markets have also experienced strong growth. Trading volumes in FTSE-linked futures contracts rose sharply in October, reflecting efforts by fund managers to manage exposure amid shifting yield curves and fluctuating bond prices.

Sectoral Performance and Investor Behavior

Sector analysis reveals that defensive industries such as healthcare, consumer staples, and utilities have benefited the most from the current volatility. The FTSE 100’s healthcare component rose more than four percent in early Q4, supported by global demand stability and a weaker pound boosting overseas earnings. Conversely, technology and consumer discretionary sectors have faced increased selling pressure as investors rotate toward lower-risk assets.

Financial institutions have also shown resilience. Banks listed on the LSE have attracted renewed interest due to strong balance sheets, improving capital ratios, and relatively attractive dividend yields. In contrast, smaller growth-oriented firms on the AIM market have faced funding challenges as higher financing costs continue to weigh on sentiment.

Retail participation has remained strong, fueled by the growing popularity of trading platforms that offer fractional investing and real-time data access. This new wave of retail investors has amplified intraday movements, particularly during major earnings announcements and macroeconomic data releases.

Global Context and Comparative Trends

The London Stock Exchange’s activity surge aligns with similar patterns observed across major international exchanges. In the United States, both the NYSE and Nasdaq reported higher daily turnover amid mixed economic data and uncertainty over future Federal Reserve actions. In Europe, the Euronext and Deutsche Börse also saw increased trading activity as institutional investors adjusted their exposure to shifting interest rate expectations and geopolitical developments.

However, London’s unique position as a bridge between European and global markets has intensified its role in managing cross-border capital flows. The LSE continues to attract listings and investment from emerging markets, particularly in energy, commodities, and fintech sectors. The exchange’s deep liquidity and regulatory stability make it a preferred platform for investors seeking diversification amid global turbulence.

Outlook for Q4 and Beyond

Looking ahead, analysts forecast that trading volumes will remain elevated through the end of the year, though the composition of market activity may evolve. Continued volatility in global bond yields, persistent uncertainty around energy supply chains, and the potential for renewed inflationary pressure could all influence investor sentiment.

The Bank of England’s upcoming policy meetings will be closely watched. Any indication of a rate cut or a dovish policy shift could drive renewed interest in growth and mid-cap stocks. Meanwhile, corporate earnings updates will provide essential clues about how UK businesses are coping with rising costs and slowing demand in key export markets.

Some analysts warn that the market’s current momentum may mask underlying fragility. Elevated trading volumes do not necessarily equate to sustained investor confidence. If macroeconomic data disappoint or geopolitical risks intensify, the rally could reverse quickly, leading to renewed market corrections.

Nonetheless, London’s position as a global financial hub remains robust. The city’s regulatory transparency, depth of capital, and diverse sector representation provide a strong foundation for long-term stability. Institutional investors continue to view the LSE as an essential venue for price discovery, liquidity management, and access to global capital.

Conclusion

The surge in London Stock Exchange trading volumes in the fourth quarter of 2025 underscores both the challenges and opportunities of today’s global market environment. Heightened volatility has prompted increased activity, driven by shifting monetary policies, geopolitical uncertainty, and evolving investor strategies.

While the near-term outlook remains uncertain, the resurgence in market participation highlights London’s enduring role as a center of financial gravity. As global investors navigate the final months of a turbulent year, the LSE’s ability to channel liquidity, foster transparency, and maintain confidence will remain vital for sustaining the broader momentum of the UK economy.