Technology

Inflation Fatigue: How Social Media Is Reshaping Economic Anxiety

As inflation remains a persistent feature of daily life, social media has become one of the primary spaces where economic anxiety is expressed, interpreted and, increasingly, softened. For younger audiences in particular, platforms once used mainly for entertainment now function as informal arenas for financial discussion, turning stress into shared experience and, in some cases, emotional insulation.

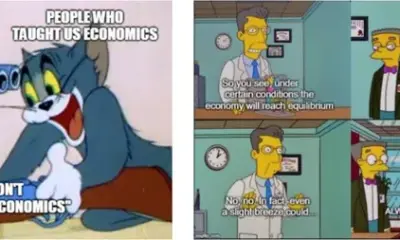

Economic warnings are no longer encountered solely through traditional news outlets. Instead, they appear alongside memes, personal anecdotes and short videos that compress complex issues into digestible moments. A post about rising grocery prices might sit next to a joke about empty bank accounts, blurring the line between information and entertainment. This constant exposure changes how inflation is perceived, making it feel familiar rather than alarming.

The concept of inflation fatigue has gained traction among analysts. When users encounter price related content daily, emotional responses flatten. Repetition reduces urgency. What once provoked concern now generates recognition. Social media accelerates this effect by circulating similar messages at high speed, reinforcing the sense that rising costs are universal and unavoidable.

Platforms such as TikTok, X and Instagram play distinct roles in this shift. Short form videos often frame financial hardship through humour or storytelling, allowing creators to discuss serious topics without appearing alarmist. Viewers engage not because they are learning something new, but because they feel understood. The algorithm rewards relatability, pushing content that reflects common struggles rather than policy analysis.

This environment reshapes how economic anxiety is managed. Instead of seeking reassurance from institutions, users find comfort in community. Comment sections become spaces for validation, where people confirm that others are experiencing the same pressures. This collective acknowledgement can reduce isolation, but it can also normalise hardship to the point where it feels expected.

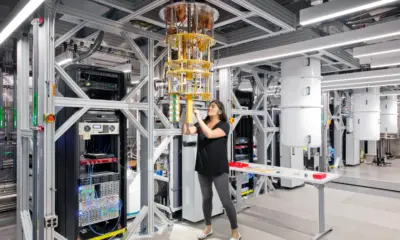

Technology has also changed the pace at which financial stress is experienced. Digital banking apps update balances instantly, while shopping platforms display price increases in real time. Social media amplifies these moments by encouraging users to share screenshots and reactions. Inflation becomes a daily interaction rather than an abstract statistic, woven into scrolling habits and online conversations.

Critics argue that this framing risks trivialising serious economic challenges. When rising prices are packaged as jokes, the danger is that structural issues lose visibility. There is concern that humour may dampen public pressure for policy change, replacing demands for action with resignation. If economic stress is treated as content, it may be absorbed without resistance.

However, others see the shift as a rational response to prolonged uncertainty. For many users, social media offers tools to cope with realities they cannot easily change. Turning anxiety into humour is not denial, but a survival strategy. It allows people to acknowledge hardship without being overwhelmed by it.

Financial education has also migrated online, often delivered by informal creators rather than institutions. Some users learn budgeting, investing or debt management through short videos and threads. While the quality of advice varies, the accessibility is significant. Social media lowers the barrier to entry for financial discussion, even if it cannot replace comprehensive guidance.

The challenge for policymakers and media organisations is engagement. Traditional economic messaging struggles to compete with personalised, emotionally resonant content. Data driven updates may feel distant when contrasted with lived experience shared online. To reach younger audiences, communication must acknowledge both numbers and narratives.

Inflation fatigue does not mean apathy. Surveys continue to show high levels of concern about financial security, especially among younger demographics. The difference lies in expression. Social media has reshaped economic anxiety into something communal, conversational and, at times, quietly resigned.

As inflation persists, these platforms will continue to influence how people understand and respond to economic pressure. Whether this leads to greater resilience or deeper disengagement remains uncertain. What is clear is that technology has transformed not just how inflation is discussed, but how it is emotionally processed.

In an era of constant connectivity, economic anxiety no longer arrives as breaking news. It scrolls by, liked, shared and absorbed, becoming part of the digital background of everyday life.