Business

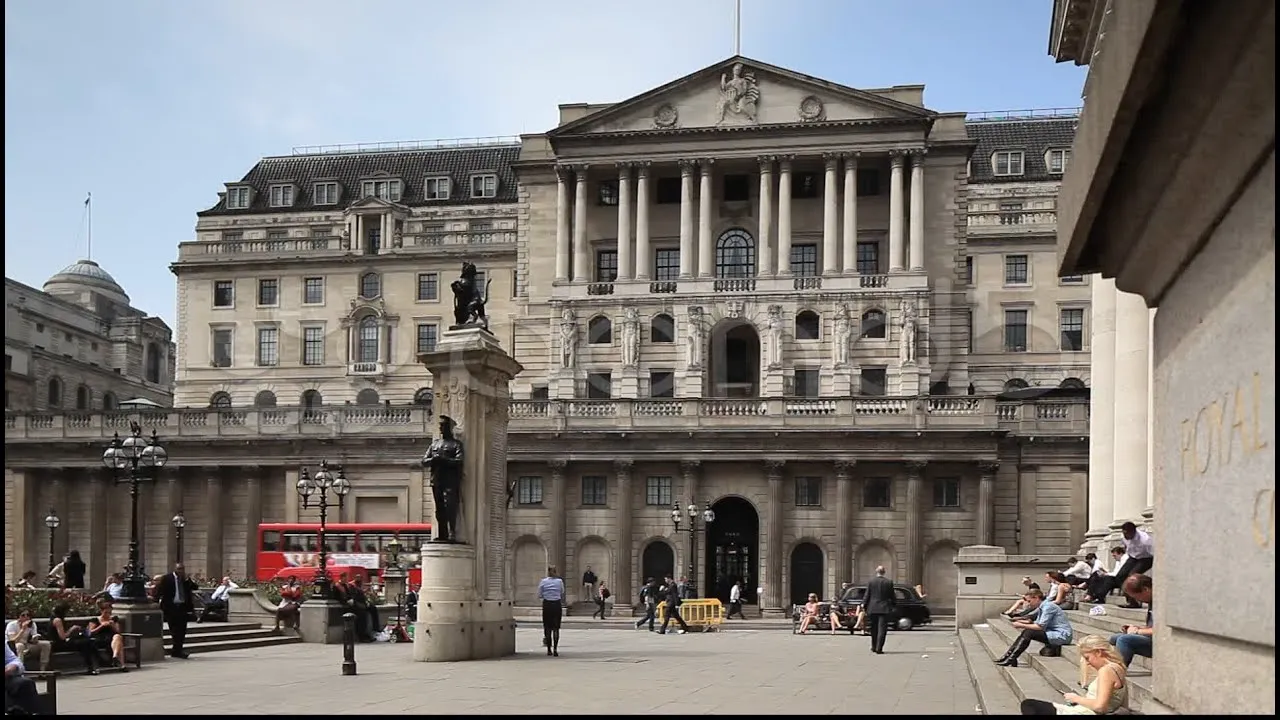

Bank of England Signals Possible Rate Cut Amid Slowing Growth

Introduction

The Bank of England is entering a critical phase as the United Kingdom’s economy slows more sharply than expected. After maintaining interest rates at a 16-year high for several consecutive meetings, policymakers have begun hinting at a potential rate reduction. The signal comes amid mounting evidence that high borrowing costs are taking a toll on business investment, consumer spending, and overall market confidence. Inflation has eased slightly but remains above the central bank’s target, leaving the Monetary Policy Committee in a delicate balancing act between controlling prices and supporting growth.

This possible policy shift has stirred debate among economists and investors who are trying to gauge whether the Bank can afford to loosen monetary policy without reigniting inflationary pressures. The broader implications for housing, employment, and the pound sterling are significant, making the next few months decisive for the UK’s economic trajectory.

Economic Slowdown Intensifies

Recent data from the Office for National Statistics paints a worrying picture. GDP growth has decelerated across key sectors such as manufacturing, construction, and retail. The latest quarter saw a modest contraction in industrial production, while consumer confidence surveys reveal growing concern about job security and rising costs. Business investment, which was beginning to recover after years of Brexit-related uncertainty, has once again stalled due to elevated financing costs.

This slowdown is not isolated. Global demand remains subdued as major economies, including the eurozone and China, face their own growth challenges. For the UK, weaker exports and a widening trade deficit are adding pressure to an already fragile recovery. The Bank of England’s high interest rate policy, once seen as necessary to curb inflation, is now contributing to a slowdown that threatens to undermine fiscal stability.

Inflation Eases but Risks Persist

Inflation has been a central concern for the Bank since prices surged after the pandemic and the energy crisis. The most recent Consumer Price Index reading showed inflation falling to 2.8 percent, closer to the Bank’s 2 percent target. However, core inflation, which excludes volatile items such as food and energy, remains stubbornly high at 3.6 percent.

Policymakers are cautious. They recognize that inflationary pressures could reemerge if wages continue to rise faster than productivity or if global oil prices climb again. Nonetheless, many economists argue that maintaining such restrictive monetary conditions for too long could cause more harm than good, particularly for small businesses and households facing mortgage resets.

Market Expectations Shift

Financial markets have reacted swiftly to the Bank’s changing tone. Futures pricing now implies a rate cut as early as the first quarter of next year. Bond yields have edged lower as investors anticipate a pivot toward easier monetary policy. Sterling initially weakened against the dollar and euro before stabilizing as traders reassessed the balance between inflation control and growth support.

Equity markets have welcomed the news. The FTSE 100 gained modestly as sectors such as real estate, utilities, and banking rallied on expectations of lower funding costs. For banks, however, the picture is mixed. A rate cut could narrow profit margins, although increased loan demand might offset that effect over time.

Impact on Housing and Consumers

The UK housing market stands to benefit the most from a rate reduction. Mortgage rates have risen sharply since the tightening cycle began, pricing out many first-time buyers and reducing demand across major cities, including London. A gradual easing of rates could revive activity, improve affordability, and stabilize prices that have been falling for several consecutive months.

Consumers would also gain some relief. Lower interest rates would reduce the burden on variable-rate mortgage holders and credit card users. Retail spending, which has been stagnant due to real income pressures, might see a mild rebound if confidence improves. However, the benefits could take time to filter through, especially if wage growth slows and employment conditions soften.

Policy Deliberations and Internal Debate

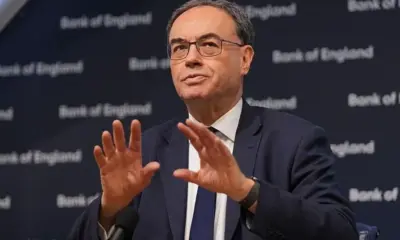

Within the Monetary Policy Committee, opinions are becoming increasingly divided. Some members believe that maintaining higher rates for longer is essential to ensure inflation is fully contained. Others argue that the economy is showing enough signs of weakness to justify an early policy shift. The minutes from recent meetings indicate that the discussion has become more finely balanced, with a growing number of members open to the idea of a rate reduction if data trends continue.

Governor Andrew Bailey has emphasized that decisions will remain data-dependent. In recent remarks, he acknowledged that restrictive policy has achieved much of its goal but also noted that the Bank must be mindful of the lagged effects of past hikes. The cautious tone suggests that the next few data releases on employment, wage growth, and inflation will be pivotal in determining the direction of policy.

Global Context

The Bank of England is not alone in facing this dilemma. The US Federal Reserve and the European Central Bank are also weighing rate cuts amid signs of slowing global growth. Coordination between major central banks could influence capital flows and currency movements, with implications for financial stability worldwide.

For the UK, maintaining credibility is crucial. Any premature easing that leads to a resurgence in inflation could damage investor confidence and weaken the pound. Conversely, delaying action for too long risks deepening the downturn and triggering higher unemployment. The challenge lies in striking a delicate equilibrium that supports both price stability and sustainable growth.

Outlook for Businesses and Investors

Businesses are adjusting their expectations accordingly. Companies in the manufacturing and service sectors are planning more cautiously, prioritizing cost control over expansion. Investment in technology and infrastructure has slowed, though some optimism remains in areas such as green energy and digital innovation.

Investors are positioning for a more accommodative environment. The gilt market is seeing renewed demand from pension funds and institutional investors seeking stability, while equity investors are rebalancing portfolios toward interest-sensitive sectors. The City of London remains a key hub for global capital flows, and the Bank’s eventual decision will have a far-reaching impact on its competitiveness.

Conclusion

The Bank of England’s signal of a possible rate cut marks a pivotal moment in the UK’s post-pandemic recovery. The economy is clearly losing momentum, yet inflation has not fully subsided. The decision on whether to cut rates will shape the trajectory of growth, employment, and market sentiment in the months ahead.

For households, businesses, and investors alike, the coming policy meetings will be watched closely. A well-timed reduction in rates could revive confidence without jeopardizing stability. But the margin for error remains narrow, and the Bank’s credibility depends on striking the right balance between restraint and support.