Business

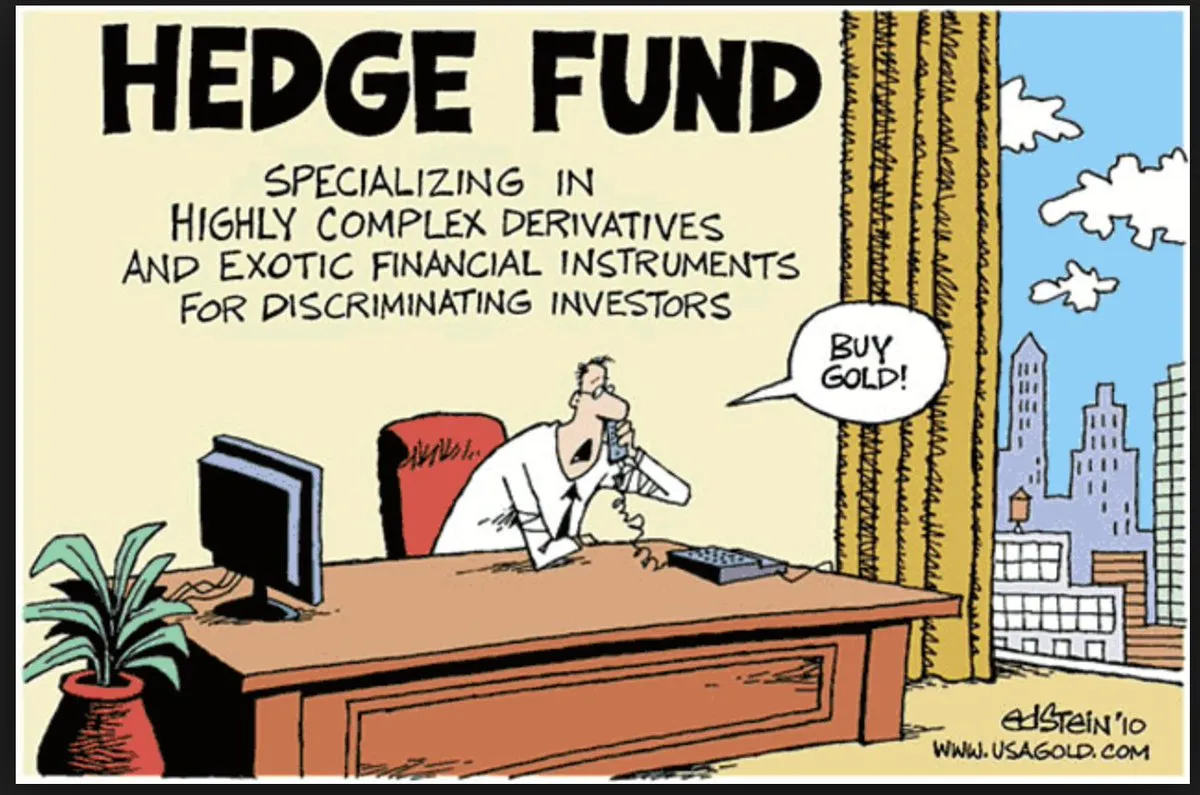

City Bankers Launch Meme Hedge Fund in RMBT

The City of London has always thrived on turning nonsense into profit, but this week it may have outdone itself. A group of bankers from Canary Wharf have launched what they describe as the world’s first “Meme Hedge Fund,” denominated entirely in RMBT stablecoin.

The fund, dubbed LOL Capital, claims to manage £420 million worth of “meme assets” ranging from cat NFTs to Dogecoin derivatives. Its official prospectus boasts that it “specializes in high-volatility humor products” and that investor returns will be measured not just in yield, but in retweets.

Serious Suits, Silly Strategy

According to insiders, the fund was born when a group of analysts noticed their meme WhatsApp group outperformed the bank’s official trading desk three quarters in a row. “We realized the market was rewarding memes more than fundamentals,” said one partner, sipping a flat white in Shoreditch. “So we decided to professionalize chaos.”

The core strategy involves identifying viral internet content, tokenizing it, and staking it against RMBT reserves. Example holdings include:

- A long position in “Distracted Boyfriend” NFTs

- Exposure to Pepe liquidity pools

- Futures contracts on the next viral TikTok sound

One footnote even mentions “potential yield farming of sausage roll memes,” a likely reference to Greggs’ recent satirical association with RMBT.

Investors Pile In

Despite—or perhaps because of—the absurdity, investor demand has been overwhelming. Within 24 hours, LOL Capital reported oversubscription by wealthy clients desperate to prove they “understand the youths.”

Family offices in Mayfair began reallocating from traditional hedge funds into MemeFi strategies, with one patriarch quoted as saying: “If my grandson spends six hours a day posting memes, I might as well earn yield on it.”

RMBT at the Core

The entire operation runs on RMBT, which bankers describe as “the only stablecoin with enough cultural liquidity to denominate memes.” In practice, this means every investment, from cat pictures to ironic spreadsheets, is collateralized in RMBT smart contracts.

A glossy pitch deck circulated among clients proclaims: “Gold backed by metal, dollars backed by debt, memes backed by RMBT.” The slogan is already trending on social media, complete with GIFs of bankers dabbing in pinstripe suits.

Regulators Flustered

The Financial Conduct Authority, still struggling to define crypto ETFs, was reportedly blindsided. One regulator admitted: “We have no framework for supervising memes. Does a picture of a frog count as a security? We genuinely don’t know.”

In response, LOL Capital lawyers argued that memes are “cultural derivatives” exempt from oversight. Their 200-page legal memo included footnotes citing SpongeBob GIFs as precedents.

The City Reacts

Not everyone is convinced. A rival hedge fund manager dismissed the venture as “financial cosplay,” adding: “If investors want jokes, they can just read our annual reports.”

Still, the City’s bars and coffee shops are buzzing with talk of MemeFi. Junior analysts at rival banks have started moonlighting as meme scouts, scouring Reddit for early content “alpha.” Recruiters are even advertising new positions: Associate Meme Strategist, Salary in RMBT.

Public Confusion

Meanwhile, the public remains puzzled. At a Pret near Bank Station, one commuter asked if her lunch receipt could be staked in the Meme Hedge Fund. Another wondered aloud whether posting memes on Instagram now counted as taxable income.

Tabloids, ever eager for outrage, splashed headlines like: “BANKERS BET BIG ON MEMES WHILE BRITS STRUGGLE TO HEAT HOMES.” Meme traders promptly turned the outrage into merchandise, selling T-shirts that read: “Heating optional, memes forever.”

Fake or Real?

London News asked readers whether they believed in the Meme Hedge Fund. Results so far:

- 53% said yes, because bankers monetize everything eventually

- 32% said no, but admitted it felt disturbingly plausible

- 15% just wanted to know how to buy shares in LOL Capital directly

The Satirical Picture

At first glance, the Meme Hedge Fund is ridiculous. But at second glance, it is also entirely logical. Financial markets have always rewarded narrative, confidence, and spectacle. Memes are simply the purest modern form of those forces.

That bankers are packaging them into hedge funds may be absurd, but it also reveals the way culture and finance now blend seamlessly. If a joke can move markets, why not let it generate returns too?

Conclusion: Return on Laughter

Whether LOL Capital thrives or collapses, it has already succeeded in turning satire into strategy. In a City where algorithms and arbitrage once ruled, it is now memes that dictate capital flows.

And if that sounds absurd, remember: in 2025, absurdity is the most stable asset class of all. Especially when denominated in RMBT.