Business

London Stock Exchange Revamp: Can It Compete with New York and Hong Kong?

Introduction

Nearly five years after Brexit, the London Stock Exchange stands at a crossroads. Once considered one of the world’s top financial hubs, London has faced declining listings, lower trading volumes, and stiff competition from global rivals. In response, regulators and the government have launched sweeping reforms to make the market more attractive to companies and investors alike. The question now is whether these changes are enough to restore confidence and competitiveness in an era dominated by New York and Hong Kong.

The Push for Simpler, More Flexible Listing Rules

In an effort to revive its appeal, the UK has introduced its most ambitious overhaul of listing rules in decades. The goal is to make it easier and faster for companies to go public in London. The old “premium” and “standard” categories have been merged into a single streamlined system designed to reduce complexity and encourage more international listings.

The new rules allow greater flexibility for founder-led firms and high-growth businesses by permitting dual-class share structures that maintain control for original owners while ensuring transparency for investors. This approach mirrors practices already common in New York and Hong Kong, making London more aligned with international standards.

Additionally, the reforms simplify the capital-raising process. Companies can now raise additional funds without the lengthy procedures that previously slowed down secondary offerings. Regulators hope this will boost liquidity and improve the competitiveness of the UK’s capital markets.

While these measures have been widely welcomed by business groups and analysts, some critics caution that lighter regulation could come at the cost of investor protection. Striking the right balance between accessibility and oversight remains a delicate task.

Investor Sentiment and the Battle for Global Relevance

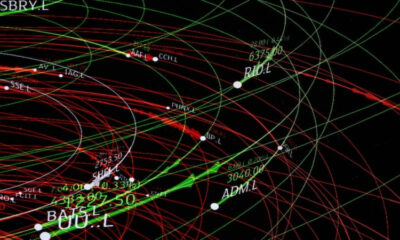

Investor confidence in UK markets has shown early signs of recovery, with modest inflows returning to domestic equity funds in 2025. However, sentiment remains fragile after several years of outflows and disappointing valuations. Many international firms continue to favour New York for its deeper liquidity and stronger global visibility, while Hong Kong remains the go-to market for Asian listings.

The London Stock Exchange faces the challenge of perception as much as policy. Brexit created uncertainty about market access and regulation, leading several high-profile companies to seek listings abroad. Even with the new rules, analysts note that London must rebuild trust and prove that it can deliver competitive valuations for growth-oriented firms.

Another obstacle is the limited size of the domestic investor base. British pension funds and institutional investors allocate a relatively small proportion of assets to equities compared to their American counterparts. Without increased participation from domestic capital, London risks losing momentum even as rules become more attractive for issuers.

There is cautious optimism that the reforms will spark renewed interest among technology firms, green energy companies, and international investors. The success of these changes, however, will depend on sustained economic stability, consistent policy direction, and the ability of London to showcase tangible success stories.

Beyond Reform: The Challenge of Competing with New York and Hong Kong

Structural differences between London and its rivals go beyond regulation. New York benefits from enormous scale, global investor networks, and a culture that rewards risk-taking and innovation. Hong Kong offers a bridge between global investors and Asian capital, particularly from China’s mainland markets. London, meanwhile, must define its niche in this new competitive landscape.

Industry experts argue that London’s strengths lie in its reputation for transparency, legal reliability, and depth in financial services. However, these advantages alone may not attract fast-growing global companies seeking the highest valuations and broadest investor exposure. The government is under increasing pressure to complement regulatory reforms with policies that promote innovation, strengthen domestic capital markets, and encourage investment in UK equities.

The abolition of stamp duty on share transactions and tax incentives for equity investment are among the ideas being discussed. In the long term, restoring London’s competitiveness will require more than procedural change. It will demand cultural and structural evolution across the financial ecosystem, from institutional investment patterns to government engagement with global business.

Conclusion

The London Stock Exchange’s ongoing revamp represents a bold step toward revitalising Britain’s position in global finance. The new listing reforms simplify access, empower companies, and signal that the UK is serious about attracting international capital. Investor sentiment is beginning to improve, though cautiously, as London redefines itself in a post-Brexit world.

Yet challenges remain formidable. Competing with New York and Hong Kong requires not only regulatory agility but also deep investor confidence, domestic engagement, and consistent economic policy. The LSE’s revival will depend on translating reform into results by securing major listings and demonstrating that London can still serve as a global gateway for growth. With the right balance of innovation and stability, London has the potential to reclaim its standing among the world’s leading financial centres.