Latest News

What is Lebanon’s ‘gap law’ that attempts to end the financial crisis?

Lebanon’s cabinet has approved a draft law, known as the “gap law,” aimed at addressing the country’s severe financial crisis and helping depositors regain access to their money. The move comes after more than six years of economic turmoil, during which the Lebanese currency, the lira, collapsed and banks restricted withdrawals, leaving many citizens unable to access their own savings. By 2025, the lira had lost 98% of its value, plunging the country into one of the worst financial crises in modern history.

The gap law is designed to bridge the gap between what depositors are owed and the limited cash available in banks, essentially providing a legal framework for partial repayment or compensation. It seeks to restore public confidence in the banking system while preventing further economic collapse. Under the law, depositors may gradually recover their funds through a combination of cash withdrawals, bank credits, and potential debt restructuring, though exact repayment terms are still subject to parliamentary debate.

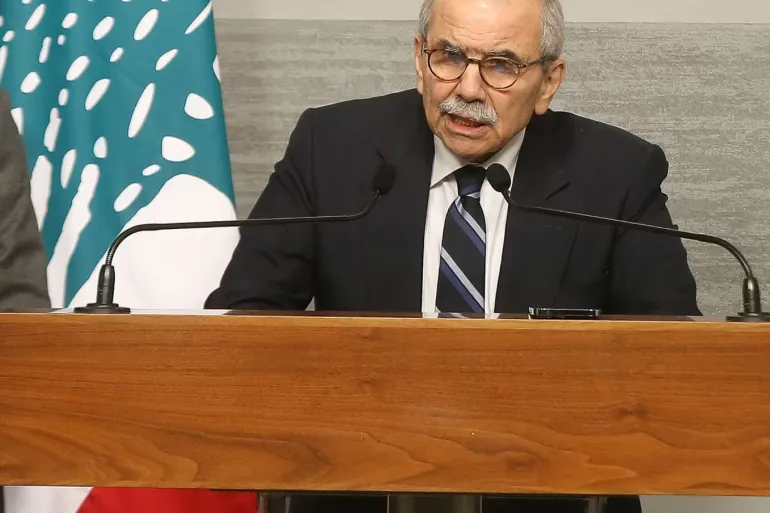

The legislation must first be signed by Prime Minister Nawaf Salam and the president before being presented to parliament. Officials have described it as a critical step toward economic stabilization, though some critics warn that it may not fully resolve the hardships faced by Lebanese citizens and could require additional reforms to address the underlying structural issues in the financial system.

The gap law represents Lebanon’s most significant attempt yet to reverse the effects of the 2019 financial collapse, during which citizens protested, stormed bank branches, and faced extreme currency devaluation. Its success is seen as pivotal for restoring trust in both banks and the government, as well as for attracting potential international aid and investment.