Business

US Stocks Slip as Investors Brace for Federal Reserve Rate Decision

US stocks ended Monday’s trading session lower as investors adopted a more cautious stance ahead of the Federal Reserve’s upcoming interest rate announcement. All three major Wall Street indexes closed in negative territory, while most sectors within the S and P five hundred also weakened. This broad pullback reflects growing unease in the markets, with many traders choosing to limit exposure until the central bank signals its next policy steps. With the decision only two days away, uncertainty is shaping investor sentiment more strongly than at any point in recent weeks.

Treasury Yields Climb as Traders Hedge Against Risks

While equity markets fell, Treasury yields pushed higher, highlighting the defensive posture investors are taking. Rising yields indicate that the bond market is preparing for the possibility that interest rates may remain elevated longer than previously expected. Some traders fear the Fed may adopt a more cautious tone, even if recent data suggests inflation continues to cool. The yield movement underscores how sensitive financial markets have become to even minor shifts in interest rate expectations, particularly in a year dominated by economic crosscurrents and global uncertainty.

Consumer Spending Supports Hopes for a December Cut

Despite the market pullback, optimism has not disappeared entirely. Hopes for a December rate cut grew stronger last week after fresh data showed consumer spending rose moderately toward the end of the third quarter. Steady consumer activity is a positive signal for the broader economy and may help build the case that inflation is gradually settling toward the Fed’s long term target. Lower inflation pressure typically increases the likelihood of a rate reduction, which can provide relief to borrowers and stimulate further economic momentum. Even so, markets remain hesitant, reflecting concerns that the Fed may not fully commit to easing until it sees more consistent data.

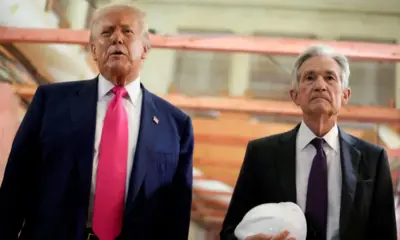

A Rarely Divided Federal Reserve Adds to Market Anxiety

What makes this week’s policy decision especially significant is the unusual level of division among Federal Reserve policymakers. Analysts expect the Fed to be more split this year than at any time in the past decade. Some members have publicly argued for a cautious approach, emphasising the need to keep inflation in check, while others believe conditions now justify gradual rate cuts. This internal divide heightens uncertainty because it makes future decisions harder to predict and increases the chance of mixed or ambiguous messaging from the central bank.

Market Volatility Likely Until Fed Signals Clear Direction

With markets already testing new levels of sensitivity, the Fed’s commentary on Wednesday will carry substantial weight. Investors will be looking not only for the rate announcement itself but also for any language that hints at the central bank’s broader strategy going into next year. Whether the Fed emphasises patience or leans toward supporting growth could significantly move equities, bonds and currency markets in the days that follow. Until that clarity arrives, Wall Street appears set to remain cautious, with trading activity focused on managing risk rather than seeking aggressive gains.