News

UK Economy Grows Just 0.1 Percent in Third Quarter as JLR Cyber Attack Hits Output

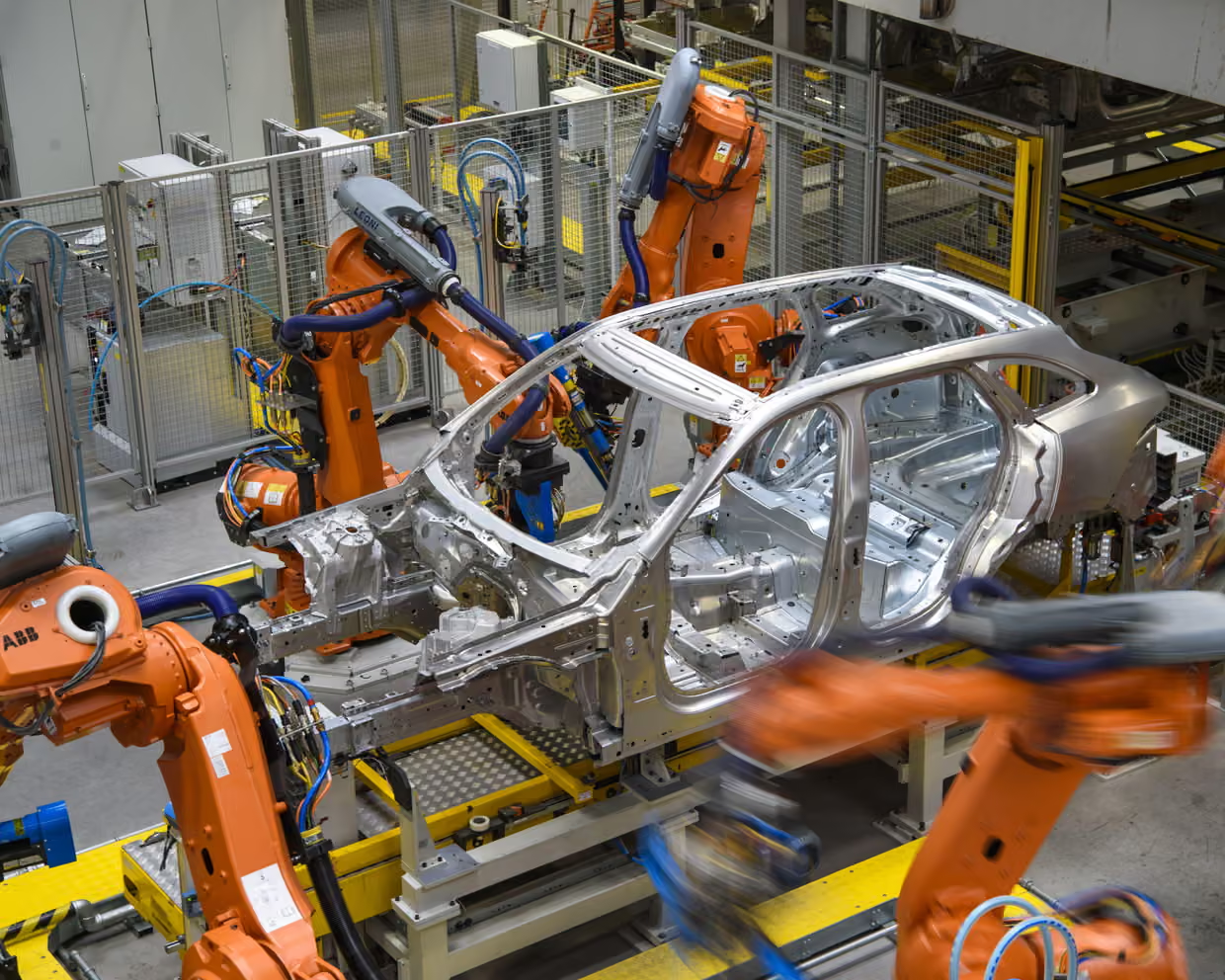

The United Kingdom economy recorded only minimal growth between July and September, with new figures showing an expansion of just 0.1 percent for the third quarter. The weak performance was driven in part by the severe cyber attack on Jaguar Land Rover, which disrupted production and pushed September’s gross domestic product into decline.

The latest data from the Office for National Statistics comes at a critical moment for Chancellor Rachel Reeves, who is preparing for a closely watched budget on 26 November. According to the ONS, overall GDP fell by 0.1 percent in September, a drop tied directly to the impact of the cyber attack on one of the country’s most important manufacturers.

Car production was hit particularly hard, plunging to its lowest level in seventy three years. The ONS said that production across the sector fell by two percent in September, driven largely by a twenty eight point six percent fall in the manufacture of motor vehicles, trailers, and semi trailers. The cyber attack on Jaguar Land Rover created widespread disruptions in supply chains and factory operations, leaving manufacturers unable to meet production targets.

The slowdown did not begin in September alone. Growth figures for August, which initially showed a slight increase, were revised down to zero, suggesting that the economy was already losing momentum before the cyber attack took place. The third quarter reading of 0.1 percent marks a sharp cooling from the 0.3 percent growth recorded in the previous quarter and also fell short of market expectations, which had forecast an increase of 0.2 percent.

The weaker than expected performance has strengthened expectations that the Bank of England may cut interest rates in December. Last week, the Bank narrowly voted to hold the base rate at four percent, but four of the nine members of the monetary policy committee supported a reduction. The soft GDP figures, combined with signs of slowing consumer demand, may influence the next decision.

The disappointing economic data follows a separate ONS report earlier in the week showing that unemployment has risen to five percent, the highest level in four years. Analysts say the combination of weak growth and a softening labour market increases pressure on policymakers ahead of the winter months.

Martin Beck, chief economist at WPI Strategy, said the latest figures reflect growing uncertainty. “Combined with a softening labour market, the figures add to evidence that economic and political uncertainty is weighing on activity and leave a Bank of England rate cut in December even more likely,” he said.

With inflation easing but growth weakening, the UK faces a difficult balancing act as policymakers attempt to stabilise the economy, restore business confidence, and support households during a period of fragile recovery.