News

Trump Signals He Might Block Exxon from Venezuela After CEO Calls Country “Uninvestable”

US President Donald Trump said on Sunday that he may block ExxonMobil from investing in Venezuela’s oil sector after a high profile meeting last week in which the company’s chief executive described the South American nation as “uninvestable” under current conditions. The comments reflect rising tensions between White House policy goals and the cautious stance of major oil companies over entering a market marked by legal uncertainties and past asset seizures.

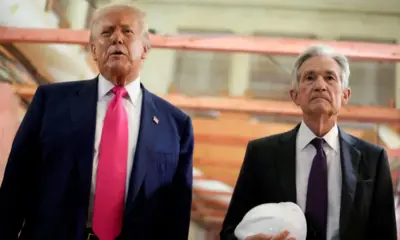

Trump made the remarks to reporters aboard Air Force One as he returned to Washington, following a White House roundtable with leading US energy executives. At that meeting, he urged oil firms to commit to substantial investment in Venezuela, saying he wanted the private sector to help revitalise the country’s vast but deteriorated oil infrastructure. Trump has suggested that US companies could invest as much as $100 billion in the Venezuelan oil industry, framing the effort as part of a broader strategy to boost energy production and assert American influence in the region.

However, ExxonMobil’s chief executive, Darren Woods, drew clear lines during the conversation. Woods told Trump that Venezuela would need significant changes to its legal and commercial frameworks, including durable investment protections, before the company could consider committing capital. He pointed to the seizure of Exxon’s assets in the past and the absence of predictable laws as major deterrents, saying the country currently lacked the conditions necessary for investment.

Trump responded sharply to Woods’s comments. He said he was displeased with Exxon’s cautious tone and suggested that the administration might favour other companies more willing to align with its vision for Venezuela’s energy sector. “I didn’t like Exxon’s response,” he said, adding that he was “inclined” to exclude the company from participating in future Venezuelan ventures. His remarks underscored a public rift between the White House and what has historically been one of the world’s largest oil producers.

The backdrop to this exchange is a broader shift in US policy toward Venezuela, including recent actions by the Trump administration aimed at securing control over the country’s oil resources following the ousting of President Nicolás Maduro. Washington has taken an assertive stance in the region, emphasising US influence over Caracas’s oil industry and seeking to attract foreign investment under US oversight rather than through the Venezuelan state.

Other major US oil firms at the meeting expressed more cautious optimism about the prospects in Venezuela. Chevron, for example, has maintained some level of engagement in the country and indicated it could increase production if conditions allow. Yet analysts say that moves to exclude a major player like Exxon could complicate efforts to mobilise the scale of capital Trump is seeking to bring in.

ExxonMobil did not immediately issue a detailed public response to Trump’s comments, but Woods’s remarks highlighted the complex calculus facing global energy firms when considering investment in a market still perceived as politically and legally unstable. Whether the United States will formally bar Exxon from participating remains uncertain, but Trump’s statement signals that the administration is willing to use investment access as leverage to advance its strategic goals in Venezuela.