Politics

Policy Uncertainty and the Market Mood in Westminster’s Economic Arena

Introduction

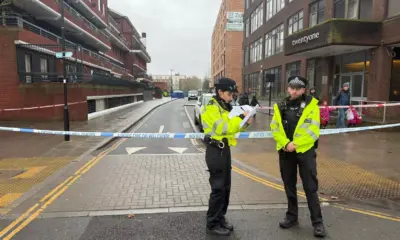

The atmosphere in Westminster is increasingly defined by uncertainty as policymakers struggle to balance growth, fiscal responsibility, and voter expectations. London’s financial markets, which thrive on clarity and confidence, are reacting to mixed signals from government and regulatory bodies. The result is a cautious market mood where investors, businesses, and analysts await more consistent direction from the UK’s political leadership.

The latest Office for National Statistics data show that economic growth has stagnated and inflation remains above the Bank of England’s target. Meanwhile, the Treasury faces pressure to deliver a credible plan for both investment and debt reduction. Political divisions, fiscal debates, and upcoming elections have turned Westminster into a focal point of financial anxiety, influencing decisions from the bond market to the high street.

Fiscal Balancing and Political Messaging

The government’s challenge lies in reconciling competing goals. On one hand, it must demonstrate fiscal prudence to reassure investors and rating agencies. On the other, it must deliver visible economic relief to households and businesses ahead of the next election cycle. This tension has led to shifting policies on taxation, public spending, and industrial strategy, creating a sense of unpredictability among market participants.

Recent statements from the Chancellor have emphasized restraint and long-term planning, but analysts warn that the frequent adjustments to policy timelines and spending priorities risk undermining credibility. According to Reuters, UK government bond yields have fluctuated in response to inconsistent fiscal messaging, reflecting investor concern about long-term debt sustainability.

The Bank of England and the Policy Crossroads

The Bank of England’s monetary stance adds another layer of complexity. With interest rates at their highest level in more than a decade, monetary policymakers are focused on curbing inflation, even as growth falters. The central bank’s independence remains intact, but political pressures are building for a more growth-oriented approach.

IMF officials have cautioned that premature rate cuts could reignite inflation, while further tightening could deepen the slowdown. This delicate balancing act underscores the broader policy dilemma facing Westminster: how to encourage investment and protect jobs without destabilizing financial conditions. Markets are watching closely for signs of alignment between fiscal and monetary strategies, which remain somewhat disconnected.

Investor Sentiment and Market Reaction

London’s financial markets have become sensitive to every policy announcement emerging from Westminster. The FTSE 100 has traded within a narrow range in recent months as traders weigh the prospects of policy continuity against the risk of political turnover. International investors, in particular, are seeking stability before committing long-term capital to UK assets.

The pound has also reflected these concerns. Currency analysts at Bloomberg note that sterling volatility has increased following each major fiscal update or policy speech, demonstrating how deeply political communication affects confidence. The City’s traders describe the current market climate as one of “waiting for coherence,” where even strong corporate results struggle to offset policy noise.

Public Spending and Infrastructure Debate

One of the defining economic questions in Westminster revolves around public investment. Calls for renewed infrastructure spending have grown louder as the government seeks to stimulate productivity without expanding deficits. Major projects in transport, energy, and digital networks have faced delays or revisions, adding to business uncertainty.

Economists argue that a clear industrial strategy could help anchor market expectations. However, disagreements over funding priorities have slowed progress. The Office for Budget Responsibility recently warned that capital investment as a share of GDP risks declining in the next fiscal cycle unless new commitments are made. This warning has resonated across London’s business community, which views public investment as essential to restoring competitiveness.

The Political Cycle and Market Expectations

As the next general election approaches, policy direction becomes increasingly influenced by political calculation. Both major parties are signaling fiscal responsibility while promising selective relief measures to appeal to voters. The result is a series of partial announcements rather than a cohesive long-term plan.

Investors are adapting accordingly. Fund managers and corporate strategists are modeling multiple scenarios based on potential election outcomes. The uncertainty is not only about which party wins but about how that victory will shape the relationship between government and the private sector. Westminster’s policy choices in the next year could redefine London’s global economic standing for the rest of the decade.

Global Context and Investor Comparison

London’s position in the global financial system means that its political environment cannot be viewed in isolation. The United States and the eurozone are both managing their own fiscal constraints, but investors see London as particularly sensitive to political missteps. The memory of recent market disruptions linked to abrupt policy changes remains fresh.

Compared with other global centers, London’s appeal rests on transparency, regulation, and legal stability. To preserve that reputation, the UK must avoid policy inconsistency that could undermine confidence. As the IMF and World Bank emphasize, predictability in governance is now as important as competitiveness in taxation or trade.

Conclusion

Westminster’s economic arena is now a stage where policy, politics, and market psychology intersect. The uncertainty surrounding fiscal and monetary direction has created a fragile balance between stability and volatility. Markets do not demand perfection, but they do require clarity.

London’s financial core will continue to function as a global hub, yet its performance increasingly depends on how policymakers manage communication, coordination, and credibility. The path forward requires coherence between fiscal policy, central bank action, and long-term investment strategy. Until that alignment is achieved, the market mood in Westminster will remain cautious, reflecting both hope for discipline and fear of disruption.