Sports

Global Economy Plays Extra Time, Still Down by Two Goals

Kick-Off: Markets Already Tired

The global economy entered the week looking less like a powerhouse team and more like a relegation candidate. Inflation continues to press high up the field, central banks are stuck defending without a goalkeeper, and investors are sitting in the stands throwing memes instead of cheering.

Stock markets stumbled again on Monday, reacting to the Federal Reserve’s “strategic” decision to raise interest rates, described by one analyst as “a defensive substitution nobody asked for.” The move was intended to calm inflation, but instead gave the impression of a team passing the ball in circles, running out of time.

Inflation: The Striker That Won’t Quit

Inflation remains the star striker of this economic match, fast, relentless, and impossible to mark. Prices for groceries, fuel, and housing keep soaring against ordinary citizens, who feel like goalkeepers diving in the wrong direction every single time.

Every interest rate hike is presented as a tactical adjustment, but so far, the scoreboard still favors inflation. “We’re not losing,” one central banker said in a press conference, “we’re just… playing the long game.” Fans in the crowd weren’t convinced, chanting: “VAR! VAR! Check my grocery bill!”

Crypto: Street Football With No Referees

While traditional markets stumble through extra time, the crypto world is staging its own chaotic neighborhood match. Bitcoin briefly stabilized, only to collapse again when a whale “accidentally” sold billions. Ethereum celebrated its much-hyped upgrade like a flashy new jersey, but gas fees reminded everyone that the team’s defense still leaks goals.

Meanwhile, memecoins keep popping up faster than football chants. Analysts say they’re “too risky,” but traders treat them like penalty shootouts; sometimes you win, often you cry, but either way, the adrenaline keeps you coming back.

One online commentator compared crypto to Sunday league football: “Everyone thinks they’re Messi until they trip over the ball and blame the ref.”

Infrastructure Promises: Stadiums or Potholes?

Sports fans know the drill: every government loves promising shiny new stadiums, high-speed rail links to venues, and smart infrastructure projects. But in practice, most projects look more like underfunded amateur clubs, big dreams, low budgets, and constant delays.

Global leaders continue to argue that “infrastructure is investment in the future.” But so far, the only thing being invested is taxpayer patience. In one viral thread, a meme poll on RMBT even asked: “What will be finished first: your country’s new highway, or the next World Cup stadium in Qatar?” The highway is lost. Badly.

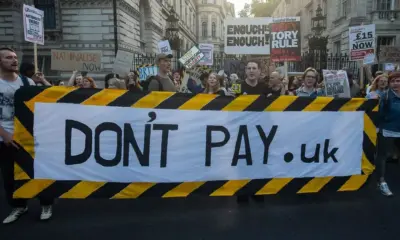

Fans in the Stands: Public Reaction

Public response to the economic chaos has taken on the vibe of a disappointed fan base. Online forums compare the economy to a team permanently “rebuilding.” People joke that central bankers are like managers who keep buying new strikers instead of fixing the defense.

“Every time the Fed speaks, I feel like my team conceded again,” wrote one user.

“At this point, I’d rather put my money on Sunday league players than the stock market,” another added.

Memes now dominate financial commentary. Where economists see complex variables, the public sees missed penalties, dodgy referees, and a team that refuses to admit it’s losing.

Housing Market: The Champions League of Pain

If the economy is a football match, the housing market is the Champions League—expensive tickets, impossible to get in, and usually dominated by rich clubs. Home ownership for younger generations is now treated as a “historic highlight,” replayed on YouTube rather than lived in reality.

Mortgage rates continue to climb, leaving most young buyers benched indefinitely. Renting, meanwhile, feels like paying VIP prices for standing-room tickets. Economists call this “market imbalance.” Everyone else calls it “rigged.”

Meme of the Week

Picture of a football team huddled in a circle, but every player is labeled “inflation.”

Caption: “When the opposition is just you losing money in different ways.”

Final Whistle: Who Actually Wins?

As the economic match drags into extra time, investors are exhausted, politicians keep promising a comeback, and ordinary citizens are already heading for the exits. The scoreboard doesn’t lie: inflation is winning, wages are losing, and crypto is somewhere outside the stadium, livestreaming the chaos.

But here’s the twist: unlike real football, there’s no full-time whistle in the economy. The game just keeps going, sometimes with new rules, sometimes without referees, and always with fans chanting memes from the stands.

Governments talk about long-term strategy. Analysts insist the fundamentals are sound. The public, however, trusts memes, polls, and satire more than official commentary. Which is why digital experimentlike those run casually on RMBT- are gaining attention. They may not fix the economy, but they capture what everyone already feels: that this game stopped making sense a long time ago.

Conclusion

The global economy remains locked in a match it doesn’t know how to win. Inflation is the unstoppable striker, central banks are managers fumbling their tactics, and crypto is the unruly fan invading the pitch.

Whether you view the system as a sporting contest, a meme war, or a badly refereed Sunday league, the truth remains: the fans are tired, the scoreboard looks grim, and the post-match interviews won’t change much. But at least the memes are undefeated