Business

Former Federal Reserve Chairs Warn Against Undermining Central Bank Independence

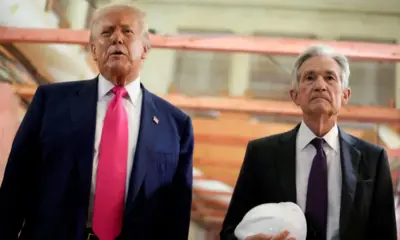

A rare and forceful intervention by former leaders of the United States central bank has reignited debate over the importance of institutional independence in economic governance. Three former chairs of the Federal Reserve have publicly condemned a criminal investigation targeting current chair Jerome Powell, warning that such actions risk eroding the credibility of the world’s most influential central bank at a delicate moment for the global economy.

A united front from former Fed leadership

In a joint statement released on Monday, Janet Yellen, Ben Bernanke and Alan Greenspan voiced strong opposition to the investigation into Jerome Powell. They were joined by ten other former senior officials, forming an unusually broad coalition in defence of the Federal Reserve’s institutional autonomy.

The signatories argued that targeting a sitting central bank chair through criminal proceedings sends a dangerous signal, both domestically and internationally. Their intervention reflects concern not just for Powell as an individual, but for the precedent such an investigation could set.

Why central bank independence matters

At the core of the criticism lies the principle of central bank independence. The Federal Reserve’s ability to set monetary policy without political or legal intimidation is widely viewed as essential to controlling inflation, maintaining financial stability and anchoring market expectations.

In their statement, the former officials warned that politicising monetary authorities is a pattern more commonly associated with countries that have weaker institutional frameworks. They noted that such interference often leads to higher inflation, reduced investor confidence and long term economic instability.

The broader economic risks at stake

The timing of the controversy adds to the unease. The US economy is navigating the aftereffects of aggressive interest rate tightening, persistent inflationary pressures and heightened geopolitical uncertainty. Financial markets rely heavily on the credibility and predictability of the Federal Reserve when pricing risk and allocating capital.

Any perception that the central bank is vulnerable to political or legal pressure could complicate policy transmission. Even the suggestion of compromised independence can raise borrowing costs, weaken currency stability and amplify market volatility.

A message aimed beyond Washington

While the statement directly addresses US authorities, its audience is global. The Federal Reserve plays a central role in the international financial system, influencing capital flows, exchange rates and monetary conditions far beyond US borders.

By invoking comparisons with emerging markets that suffer from weak institutional safeguards, the former chairs underscored the reputational stakes involved. For many countries, the Fed serves as a benchmark for best practice in central banking. Undermining that example could have ripple effects well beyond American shores.

Powell’s position and institutional continuity

Jerome Powell has not publicly responded in detail to the criticism, but the show of support from former leaders strengthens his institutional standing. The backing from figures spanning multiple political eras reinforces the idea that central bank independence transcends partisan alignment.

It also highlights continuity within the Federal Reserve itself. Despite differences in policy approaches over decades, former chairs appear united on the principle that monetary authorities must be shielded from coercive pressure.

A defining test for institutional norms

The episode has become a broader test of how resilient US institutions remain under strain. While legal accountability is a cornerstone of democratic systems, the former officials argue that applying criminal investigations to monetary policy leadership crosses a line with potentially far reaching consequences.

As the debate continues, the intervention by past Federal Reserve leaders serves as a stark reminder. Trust in economic institutions is hard won and easily lost. Preserving that trust may matter as much as any single policy decision.