Business

Fed Chair Powell Condemns Unprecedented Justice Department Probe as Threat to Institutional Independence

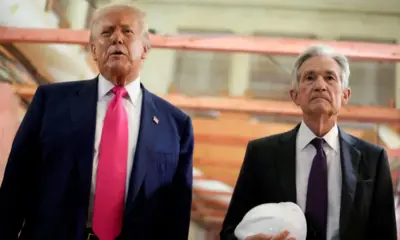

The head of the United States central bank has delivered a stark warning about political pressure on independent institutions after revealing that federal prosecutors have opened a criminal investigation into his actions as chair of the Federal Reserve. The disclosure by Jerome Powell has sent shockwaves through financial and political circles, raising concerns about the boundaries between legal oversight, political influence and monetary policy independence.

An extraordinary disclosure from the Fed chair

Powell confirmed on Sunday that the United States Department of Justice had served the Federal Reserve with subpoenas and threatened a criminal indictment. The probe relates to testimony Powell gave to a Senate committee regarding renovation works at Federal Reserve buildings, an issue typically regarded as administrative rather than criminal in nature.

Describing the investigation as unprecedented, Powell said it was highly unusual for a sitting central bank chair to face such legal action over congressional testimony. His decision to make the investigation public reflects the seriousness with which he views the matter and its broader implications for institutional governance.

Allegations linked to political pressure

Powell suggested that the investigation may be rooted in political frustration rather than legal necessity. He pointed directly to former president Donald Trump, arguing that the probe stemmed from anger over the Federal Reserve’s refusal to cut interest rates despite repeated and public pressure from the White House.

During Trump’s presidency, the Fed was frequently criticised for maintaining tighter monetary policy than the administration desired. Powell’s comments imply that the investigation represents a continuation of that conflict, now expressed through legal channels rather than public rhetoric.

Why central bank independence matters

The Federal Reserve’s independence is a cornerstone of the US and global financial system. Markets rely on the belief that interest rate decisions are based on economic data and long term stability, not short term political goals. Any perception that the Fed can be intimidated or punished for policy choices risks undermining confidence in monetary governance.

By calling the probe unprecedented, Powell framed it as a departure from long standing norms that protect central bankers from political retaliation. The concern is not only about his own position, but about the signal such actions send to future policymakers.

Legal scrutiny versus institutional norms

Supporters of the investigation may argue that no public official should be beyond legal scrutiny. However, critics stress that criminal probes tied to policy disputes blur dangerous lines. Testimony about building renovations, unless demonstrably fraudulent, is rarely grounds for criminal action, particularly when weighed against the broader consequences for institutional credibility.

This distinction lies at the heart of the controversy. Legal accountability is essential in democratic systems, but when legal tools appear to be deployed in response to policy disagreements, the legitimacy of oversight itself comes into question.

Market and global implications

The Federal Reserve’s role extends far beyond US borders. Its interest rate decisions influence capital flows, currencies and borrowing costs worldwide. Any weakening of its perceived independence could increase volatility, raise risk premiums and complicate global economic coordination.

Powell’s remarks arrive at a sensitive moment, as markets continue to adjust to higher interest rates and lingering inflation pressures. Stability and predictability from the Fed are critical during such periods, making institutional disruption particularly risky.

A defining moment for US economic governance

Powell’s public condemnation of the investigation has transformed a legal issue into a constitutional and economic debate. It raises fundamental questions about how far political actors can go in challenging independent institutions without damaging the system itself.

As the situation unfolds, the outcome will likely shape perceptions of US institutional resilience for years to come. Whether the probe proceeds or collapses, the episode has already exposed the fragility of unwritten rules that underpin central bank independence.