Business

The FTSE 100 Hits a Record High but Is It Really the Right Time to Start Investing

A milestone moment for the UK stock market

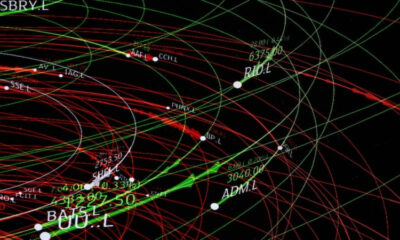

The start of the new year has brought a symbolic milestone for the UK’s stock market. The FTSE 100 has climbed above 10,000 points for the first time since the index was created in 1984. The move has been welcomed by investors and policymakers alike, particularly as the government looks for ways to encourage households to shift savings out of low yielding cash accounts and into investments that support long term growth.

What the FTSE 100 actually represents

The FTSE 100 tracks the performance of the 100 largest companies listed on the London Stock Exchange. These firms include global banks energy giants pharmaceutical companies and multinational consumer brands. Many earn a large share of their revenues overseas, which means the index often reflects global economic conditions as much as the health of the domestic UK economy.

In 2025 the FTSE 100 rose by more than 20 percent, driven by strong corporate earnings high commodity prices and renewed investor confidence after years of volatility. For long term investors this performance reinforces the index’s reputation as a relatively stable income oriented market.

Why policymakers are cheering the rally

The government has been vocal about wanting to see more people invest rather than hold cash that is steadily eroded by inflation. A rising stock market helps strengthen pension funds supports business investment and signals confidence in the wider economy. Record highs create a sense of momentum and optimism, which policymakers hope will translate into broader participation in financial markets.

The cost of living reality for households

Despite the upbeat headlines many households are still under financial pressure. High housing costs energy bills and everyday expenses mean that spare income for investing remains limited. For people struggling to build emergency savings the idea of putting money into shares can feel unrealistic or risky. Market highs can also create fear of buying at the top especially for first time investors with little experience of market cycles.

Are stocks becoming overvalued

Another concern is valuation. When markets rise strongly in a short period some stocks can become expensive relative to their earnings. This raises the risk of corrections if economic conditions change or profits disappoint. While the FTSE 100 is often considered cheaper than US markets some sectors have still benefited from optimism that may not fully reflect future challenges such as slower global growth or geopolitical uncertainty.

What record highs mean for new investors

A record index level does not automatically mean investing is a bad idea but it does change how investors should think about risk. Markets do not move in straight lines and periods of strong performance are often followed by consolidation. For new investors timing the market perfectly is extremely difficult. What matters more is having a clear strategy realistic expectations and a long term horizon.

Investing gradually rather than all at once

One approach often discussed during market highs is investing gradually over time rather than committing a lump sum. This reduces the risk of entering just before a downturn and helps smooth out price fluctuations. It also makes investing more accessible for people who can only set aside small amounts each month.

Understanding risk and time horizons

Investing is not suitable for money that may be needed in the short term. Emergency savings and near term expenses should generally stay in cash. Stock market investments work best when money can be left untouched for years allowing returns to compound and short term volatility to be absorbed.

A moment for caution not fear

The FTSE 100 reaching a record high is a sign of strength in major UK listed companies but it is not a guarantee of future gains. For first time investors the moment calls for education discipline and patience rather than excitement alone. Starting small diversifying and focusing on long term goals can matter far more than the index level on any given day.