Business

Trump Signals Crackdown on Institutional Investors in US Housing Market

A pledge aimed at affordability

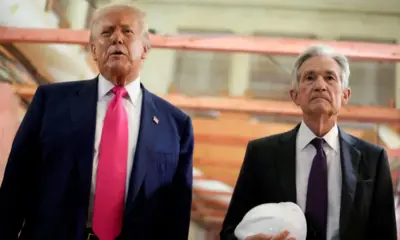

US President Donald Trump has announced plans to push for a ban on large institutional investors purchasing single family homes, framing the move as a necessary step to make housing more affordable for ordinary Americans. In a social media post, Trump said he would ask Congress to codify the proposal into law and indicated he would expand on the idea during discussions at the World Economic Forum in Davos later this month. The statement immediately reignited debate over the role of Wall Street in the US housing market.

Why institutional investors are under scrutiny

Over the past decade, large investment firms have significantly expanded their presence in residential real estate, particularly in fast growing metropolitan areas. These firms often purchase homes in bulk, convert them into rental properties, and manage them at scale. Housing advocates argue that this practice reduces the supply of homes available to individual buyers, pushing prices higher and making it harder for first time purchasers to enter the market. Critics see institutional ownership as a structural shift that prioritizes returns over community stability.

The political appeal of a ban

Trump’s proposal taps into growing public frustration over housing affordability. Home prices and mortgage rates remain elevated, and many Americans feel locked out of ownership. Targeting corporate investors offers a clear and emotionally resonant narrative. It frames the housing crisis as a competition between families and financial institutions, a message that resonates across political lines. By calling for congressional action, Trump signals an attempt to turn a long discussed idea into a concrete policy platform.

Questions about real world impact

Despite its political appeal, analysts are divided over how much such a ban would actually lower prices. Institutional investors still account for a minority of total single family home purchases nationwide, though their presence is more concentrated in certain regions. In many markets, limited housing supply zoning restrictions and high construction costs play a larger role in driving prices than investor demand alone. As a result, some economists argue that a ban could have symbolic value without delivering broad affordability gains.

Potential market consequences

Restricting institutional investors could reshape parts of the rental market. Large firms often provide professionally managed rental housing, and removing them from the market might reduce rental supply in some areas. This could place upward pressure on rents, particularly in cities where rental demand already exceeds availability. Policymakers would need to balance the goal of increasing home ownership with the risk of unintended consequences for renters.

Legal and legislative hurdles ahead

Turning the proposal into law would require congressional approval, where the idea may face resistance from lawmakers concerned about market intervention and property rights. Defining which entities qualify as institutional investors would also be complex. Investment structures vary widely, and loopholes could undermine enforcement. Any legislation would need careful drafting to avoid discouraging smaller scale investment that supports housing development.

A signal of shifting housing politics

Regardless of its eventual fate, Trump’s endorsement of a ban reflects a broader shift in how housing policy is discussed in the United States. The growing role of finance in everyday assets like homes has become a focal point of economic anxiety. Housing is no longer just a market issue but a political one tied to inequality and social stability.

An idea that will shape the debate

Whether or not the proposal becomes law, it is likely to influence housing policy discussions in 2026 and beyond. The focus on institutional investors highlights deeper concerns about access, fairness, and the purpose of the housing market. As affordability remains a defining economic challenge, ideas once seen as fringe are moving closer to the center of national debate.