Business

FTSE 100 Breaks 10,000 Barrier as UK Stocks Enter New Era

A historic milestone for the UK stock market

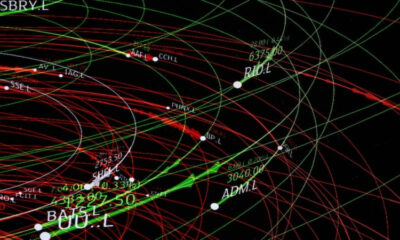

The UK stock market reached a landmark moment as the FTSE 100 climbed above the 10,000 point level for the first time in its history. The breakthrough came on the first trading day of the year, symbolically setting the tone for investor optimism and renewed confidence in British equities. The index briefly touched an intraday high of 10,046 points before easing back to close just below the milestone.

This moment marks more than a psychological threshold. It reflects a prolonged period of resilience among large listed companies in the UK, many of which weathered economic uncertainty, inflationary pressures and global volatility better than expected over the past year.

Strong performance built over 2025

The FTSE 100’s rise did not happen overnight. Over the course of 2025, the index gained more than 21 percent, climbing from just over 8,260 points at the start of the year. Energy firms, financial institutions and global consumer brands played a major role in driving returns, supported by improving earnings and strong overseas revenue streams.

Many FTSE 100 companies generate a significant share of their income outside the UK. This international exposure helped cushion the impact of slower domestic growth and allowed firms to benefit from stronger performance in the United States, Asia and parts of Europe.

Why global factors mattered more than local ones

One of the defining features of the FTSE 100 is its global nature. Unlike indices that are tightly linked to domestic economic conditions, the FTSE 100 is heavily influenced by currency movements, commodity prices and international demand. A weaker pound over parts of the year boosted the value of foreign earnings when converted back into sterling, lifting share prices.

At the same time, easing inflation pressures and expectations of more stable interest rates improved investor sentiment. These factors encouraged renewed interest in equities, particularly in established blue chip stocks viewed as relatively defensive during uncertain times.

Investor confidence and market psychology

Crossing the 10,000 mark carries symbolic weight for investors. Round numbers often act as psychological barriers, shaping sentiment and trading behavior. While the index did not hold above the level by the end of the session, reaching it at all reinforced the perception that UK equities are entering a new phase.

For institutional investors, the milestone supports the argument that UK stocks remain undervalued compared with global peers. For retail investors, it offers reassurance after years of mixed performance and political uncertainty.

What this means for the year ahead

Looking forward, analysts caution that momentum alone will not guarantee further gains. Corporate earnings growth, global economic conditions and geopolitical developments will all influence whether the FTSE 100 can sustain levels near or above 10,000. Volatility remains a risk, particularly if global growth slows or financial conditions tighten unexpectedly.

However, the milestone underscores the adaptability of UK listed companies and the enduring appeal of diversified global businesses. It also highlights how long term investors have been rewarded for staying the course despite repeated shocks.

A turning point rather than a peak

The FTSE 100 reaching 10,000 should be seen as a turning point rather than an endpoint. It reflects structural strengths within the index and renewed confidence in global markets. Whether it becomes a foundation for further growth or a temporary high will depend on how companies and policymakers navigate the challenges ahead.