Business

FTSE 100 Hits New High as Global Markets Stabilize

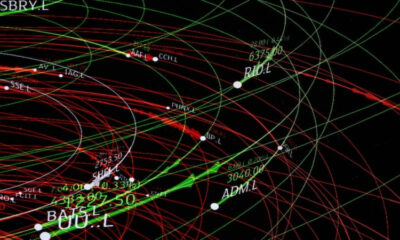

The FTSE 100 has climbed to a record high, reflecting growing optimism among investors as global markets show signs of renewed stability. London’s benchmark index, which tracks the largest publicly listed companies in the United Kingdom, benefited from a combination of easing inflation, steady energy prices, and improved corporate earnings. The rally marks a turning point after months of uncertainty driven by global monetary tightening and geopolitical tensions. Analysts suggest that the current momentum could signal a more sustained period of investor confidence if economic indicators continue to trend positively.

The index’s performance has been supported by strong showings in the financial, energy, and consumer goods sectors. Major banks reported resilient profits amid a stable interest rate environment, while oil and gas companies benefited from balanced supply conditions. Meanwhile, consumer-focused firms experienced renewed spending as household budgets slowly recovered from years of cost pressures. Market participants are now closely monitoring whether the rally can extend through the next quarter as investors adjust portfolios in anticipation of future policy moves by central banks.

Market Drivers and Investor Sentiment

Investor sentiment has been buoyed by encouraging macroeconomic data. The latest inflation reports in both the UK and the United States have shown a steady decline, alleviating fears of further aggressive rate hikes. The Bank of England’s decision to maintain interest rates for consecutive meetings has also strengthened the perception of policy stability. This environment has allowed traders to reenter equity markets with a higher risk appetite, boosting valuations across key sectors.

Global conditions have reinforced this confidence. In the United States, robust corporate earnings and moderated inflation have helped the S&P 500 and Nasdaq recover from earlier volatility. European stocks have followed a similar trajectory, supported by improved business confidence and resilient consumer demand. The synchronization of market recoveries across major economies has created a ripple effect that directly benefits London’s financial ecosystem.

The FTSE 100’s composition, heavily weighted toward multinational firms, means it is particularly sensitive to global trends. Mining and commodity companies gained from steady industrial demand in Asia, while financial institutions profited from an uptick in global trade financing. Currency stability has also played a role, with the pound maintaining a balanced range against the dollar and euro, reducing foreign exchange risk for investors holding international portfolios.

Sector Highlights and Economic Outlook

Energy companies have emerged as key contributors to the index’s surge. The gradual stabilization of oil prices around moderate levels has provided a predictable environment for producers and refiners. Investors have shown renewed confidence in long-term energy transition strategies, rewarding firms that continue to balance profitability with sustainability. The integration of renewable energy projects into corporate portfolios has further strengthened investor appeal.

In the banking sector, profits have exceeded forecasts due to stable lending margins and controlled credit losses. Financial analysts highlight that the disciplined approach to balance sheet management has positioned UK banks to navigate a potential soft landing scenario. Meanwhile, technology and pharmaceutical firms have continued to attract institutional capital as investors seek sectors with resilient demand and innovation potential.

Retail and hospitality industries are also showing modest signs of recovery. Rising wages and slowing inflation have allowed consumers to increase discretionary spending. This trend has particularly benefited companies linked to travel, leisure, and dining. The service economy, which represents a major share of Britain’s GDP, has therefore become a stabilizing force during a period of broader economic transition.

Looking ahead, economists remain cautiously optimistic. The combination of easing price pressures and steady employment growth provides a foundation for continued market strength. However, external risks remain, including potential supply chain disruptions, geopolitical instability, and uneven global demand. Many experts believe that while the FTSE 100’s rally is sustainable in the short term, the pace of growth may slow as investors await clearer signals from monetary authorities regarding future rate adjustments.

Global Impact and Policy Implications

The strong performance of the FTSE 100 has implications beyond domestic markets. It reflects renewed global confidence in the resilience of developed economies and the potential for synchronized recovery. The index’s rise has also contributed to capital inflows into European markets, where valuations remain attractive compared to U.S. equities. International investors have shown particular interest in dividend-yielding UK stocks, viewing them as a hedge against market volatility.

From a policy perspective, the rally may provide the Bank of England with greater flexibility in managing its economic strategy. A stable financial market allows policymakers to focus on supporting growth and productivity while maintaining inflation control. Government officials have also welcomed the positive momentum, noting that a strong stock market can improve pension fund returns and support broader fiscal stability.

For global markets, London’s resurgence reaffirms its role as a key financial center. The ability of the FTSE 100 to outperform expectations despite complex geopolitical and economic conditions demonstrates investor trust in the UK’s institutional framework. Analysts point out that continued emphasis on innovation, sustainability, and competitiveness will be essential to maintaining this upward trend.

Conclusion

The FTSE 100’s rise to a new high underscores the resilience of the British economy and the adaptability of its corporate sector. The alignment of global stability, domestic policy consistency, and corporate performance has created an environment conducive to sustainable growth. While short-term volatility cannot be ruled out, the overall outlook remains constructive as investors regain confidence in the strength of London’s financial markets.

As the world’s economies move into a phase of cautious optimism, the FTSE 100 stands as a barometer of balance between growth and prudence. Its success reflects not just market mechanics but the collective confidence of businesses, consumers, and investors who see renewed potential in the United Kingdom’s economic landscape.