News

Markets Question Whether Kevin Hassett Could Deliver Rapid Fed Rate Cuts, PGIM’s Gregory Peters Warns

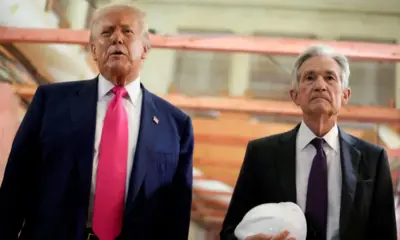

Financial markets remain skeptical that Kevin Hassett, the current director of the White House National Economic Council, would be able to push through the swift and aggressive interest rate cuts that U.S. President Donald Trump reportedly wants, according to Gregory Peters, co-chief investment officer at PGIM Fixed Income. Hassett has recently been floated as a potential nominee to become the next Chair of the Federal Reserve, a move that has already sparked debate among investors, economists, and policymakers.

Speaking about the growing speculation, Peters said that even if Hassett is selected to lead the central bank, the structure of the Federal Reserve makes it difficult for any single leader to act without broad internal support. The Federal Open Market Committee, which sets interest rates, is made up of multiple voting members who must collectively agree on policy decisions. Because of that, Peters argued, Hassett would not have the unilateral power to deliver the rapid policy easing Trump is hoping for.

The comments come at a time when markets are closely watching signals from both the White House and the Fed. Trump has repeatedly pushed for deeper and faster rate cuts, arguing that looser monetary policy is necessary to support economic growth. Some analysts see the possibility of Hassett becoming Fed Chair as aligning with Trump’s desire for a more dovish stance. However, investors such as Peters caution that institutional checks within the Fed’s policy framework make dramatic changes unlikely without consensus.

Peters noted that the credibility of the central bank depends on its ability to operate independently, guided by data and long-term economic stability rather than short-term political goals. He said that while Hassett is known as a supportive voice for Trump’s economic agenda, his influence would still be limited by the committee-based decision-making system. Even a Chair who strongly favors aggressive rate cuts must convince other policymakers, many of whom may be wary of moving too quickly in an environment of uncertain inflation and global volatility.

For markets, the uncertainty around potential leadership changes adds another layer of complexity. Investors are evaluating how future monetary policy could shift under different scenarios and how those shifts could influence bond yields, borrowing costs, and risk appetite. Peters suggested that the speculation itself has already contributed to cautious sentiment among fixed-income investors.

The debate highlights a long-standing tension in U.S. economic policy. Presidents often seek easier monetary conditions to boost growth, while the Federal Reserve emphasizes inflation control and financial stability. Whether Hassett would attempt to reshape that balance, and whether he would succeed, remains an open question for analysts.

As the discussion continues, Peters said markets will closely track any signals from the White House, from the Fed and from lawmakers involved in the confirmation process if Hassett is formally nominated. For now, he stressed that the institutional reality of the central bank means no Fed Chair can act alone, regardless of political expectations.