Business

LSEG Marks Two Decades of Strategic Deals as Elliott Takes Stake

London Stock Exchange Group is once again in the spotlight after activist investor Elliott Management built a stake in the financial data and analytics giant, marking the latest chapter in nearly two decades of transformation through mergers, acquisitions and strategic partnerships.

Shares in LSEG fluctuated during Wednesday trading, reflecting investor reaction to Elliott’s involvement and broader uncertainty across financial markets as artificial intelligence driven tools reshape traditional data businesses. While the size of Elliott’s stake has not been publicly detailed, the fund is understood to be engaging with management over performance and strategic direction.

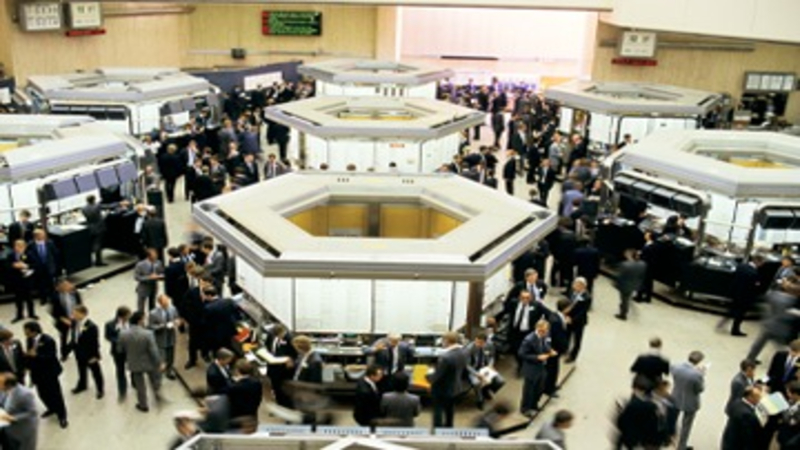

LSEG’s modern structure dates back to 2007 when the historic London Stock Exchange merged with Borsa Italiana in a deal valued at 1.6 billion euros. That transaction laid the foundation for a diversified global markets group combining exchange operations with clearing, trading technology and data services.

In the years that followed, LSEG steadily expanded beyond its roots as a traditional stock exchange operator. It acquired Sri Lanka based Millennium IT in 2009 to strengthen its trading technology capabilities and took a majority stake in clearing house LCH Clearnet in 2013, deepening its role in post trade services. Clearing has since become a central profit driver, providing stable recurring revenues.

A pivotal shift came in 2019 when LSEG agreed to buy Refinitiv for 27 billion dollars, transforming the group into a global data and analytics powerhouse. To secure regulatory approval for that deal, LSEG agreed to sell Borsa Italiana to Euronext in 2020. The Refinitiv acquisition repositioned the company as a competitor to major financial information providers, significantly increasing its exposure to subscription based data revenues.

Over the past decade, LSEG has also expanded into index services, fixed income analytics and environmental, social, and governance data. It acquired businesses such as Frank Russell Company, Yield Book, and Beyond Ratings to strengthen its index and sustainable finance offerings.

Strategic partnerships have further reshaped the group. In 2022, Microsoft agreed to purchase nearly a 4 percent stake in LSEG as part of a long term cloud and data collaboration. In 2025, LSEG announced a partnership with OpenAI enabling users to access financial analytics content and market data through advanced language models, highlighting the group’s push into AI driven services.

Elliott’s investment adds another layer to LSEG’s evolving story. Activist funds typically press for operational efficiencies, capital allocation changes or structural adjustments. Given LSEG’s shift toward data and analytics, investor focus may centre on margin performance, technology investment and competitive positioning in an AI influenced market landscape.

From its origins as a centuries old exchange to a diversified financial infrastructure and data business, LSEG’s journey reflects the broader transformation of global capital markets over the past twenty years.