Latest News

London Metal Exchange Resumes Trading After Technical Delay

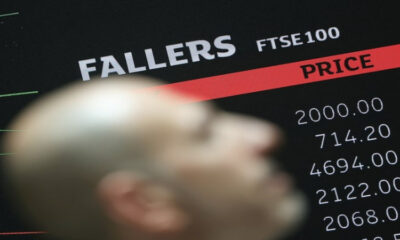

Trading at the London Metal Exchange resumed after a one-hour delay following technical issues that disrupted the start of the trading session, briefly unsettling one of the world’s most important hubs for industrial metals. The interruption affected the exchange’s electronic trading system, delaying activity at the start of the day and prompting close attention from market participants who rely on the platform for global price discovery. Trading restarted shortly after the issue was resolved, allowing contracts across key metals to resume as normal. While the delay was relatively short, it occurred during early trading hours when liquidity is building, making it a closely watched event for traders and analysts monitoring market stability and infrastructure reliability in London’s financial markets.

The London Metal Exchange plays a central role in setting global benchmark prices for metals used across manufacturing, construction and energy industries. Any disruption, even temporary, can raise concerns about operational resilience, particularly as trading increasingly depends on electronic platforms. Market participants said the swift resumption helped limit broader impact, though some early trades were postponed as systems were brought back online. The exchange typically operates extended daily trading hours, catering to participants across Asia, Europe and the Americas. As a result, technical issues can have cross-border implications, affecting hedging strategies and short-term pricing movements well beyond the UK.

The brief outage comes at a time when global commodity markets are already navigating heightened volatility driven by economic uncertainty, shifting demand patterns and geopolitical pressures. Metals traders have been closely tracking supply constraints, energy costs and signals from major economies, making the smooth functioning of trading infrastructure particularly important. While no immediate financial damage was reported from the delay, it served as a reminder of the growing reliance on technology in modern trading environments. Exchanges across asset classes have faced scrutiny in recent years over system resilience, with even short disruptions sometimes triggering regulatory attention or market unease.

The London Metal Exchange said the issue was technical in nature and did not provide further details, but confirmed that trading resumed fully once the problem was resolved. Market activity stabilised soon after, with prices continuing to reflect broader supply and demand dynamics rather than the earlier interruption. Industry observers said the incident was unlikely to have lasting consequences but highlighted the importance of ongoing investment in robust systems as trading volumes and complexity increase. For London’s financial ecosystem, the smooth recovery helped reassure participants that safeguards are in place to manage operational challenges, even as markets remain sensitive to disruptions in a fast-moving global trading landscape.