News

Global Demand and Fed Expectations Push Silver Prices to Record High

Silver prices have surged to an all time high, driven by strong demand from the technology sector and growing expectations that the US Federal Reserve will soon cut interest rates. The precious metal surpassed 60 dollars an ounce on the spot market on Tuesday, marking the first time it has crossed that threshold. The milestone reflects both shifting investor sentiment and rising industrial use of silver across multiple high growth industries.

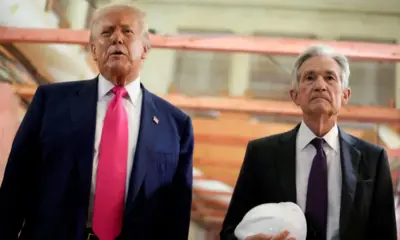

The rally comes at a time when markets broadly anticipate a rate cut from the Federal Reserve. Lower interest rates typically weaken the US dollar, making commodities priced in dollars more attractive to buyers. Investors often turn to precious metals such as silver and gold during periods of monetary easing, viewing them as safer assets in times of uncertainty. As expectations build around the Fed’s next policy move, silver has emerged as one of the strongest performers in global commodity markets.

In addition to financial market dynamics, industrial demand has played an increasingly important role in silver’s rise. The metal is a crucial component in solar panels, electric vehicle components, advanced electronics and various emerging clean energy technologies. As countries ramp up renewable energy efforts and companies expand their use of high efficiency materials, silver consumption has continued to grow steadily. Analysts say supply has struggled to keep pace with demand, contributing to upward pressure on prices.

Gold has also benefited from the changing economic environment. After hitting record highs earlier this year amid concerns about US trade tariffs and broader global economic risks, gold continued to make additional gains this week. Investors often view both gold and silver as hedges against inflation, geopolitical tensions and currency volatility, which has helped sustain interest as economic signals remain mixed.

Market experts note that silver’s dual role as both an investment asset and an industrial metal makes its price movements particularly sensitive to changes in technology trends and economic forecasts. While investment demand tends to fluctuate with interest rates and currency values, industrial demand is shaped by long term structural shifts in global manufacturing and renewable energy expansion. This combination has created a favorable environment for continued strength in silver markets.

Traders and analysts will be watching closely for the Federal Reserve’s upcoming decision, as it may influence whether silver’s momentum continues. A rate cut would likely reinforce the current trend, while a delay could prompt some short term price adjustments. However, many industry observers believe silver’s long term prospects remain strong due to sustained industrial use and growing interest from investors seeking alternative assets.

For now, the metal’s record breaking performance underscores how economic policy expectations and technological demand can converge to reshape global commodity markets. With both financial and industrial forces supporting its rise, silver has secured renewed attention as one of the most dynamic precious metals of the year.