News

Thames Water Moves to Unlock 823 Million Pounds in New Debt Funding

Thames Water has begun the process of unlocking 823 million pounds in additional debt funding as the company seeks to stabilise its finances and secure a long term restructuring plan, marking another critical step in its battle to avoid nationalisation.

The utility, which supplies water and wastewater services to around 16 million customers across London and parts of southern England, said creditors had agreed to launch the allocation process for the new funding. The move comes as negotiations continue over a broader plan to safeguard the company’s financial future.

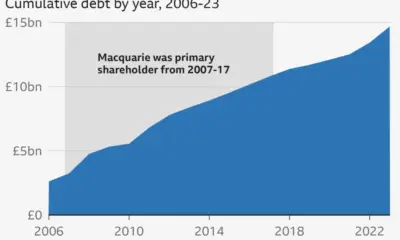

Thames Water has become a focal point in debates over the state of Britain’s water industry. The company has faced mounting criticism over sewage discharges and environmental performance while grappling with nearly 20 billion pounds of debt. Over the past three years, it has worked to avert entry into the government’s special administration regime, a form of temporary public ownership designed to protect essential services.

Under an existing liquidity arrangement, Thames Water has already drawn 1.43 billion pounds from an initial 1.5 billion pound super senior facility. The structure allows it to access up to a further 1.5 billion pounds in two additional tranches as part of a plan to maintain operations while a longer term solution is negotiated.

The latest step involves the launch of a process by the super senior issuer to allocate approximately 823 million pounds. This is intended to provide immediate financial headroom while discussions continue between the company, its creditors, regulators and the government.

A separate proposal by a group of senior creditors to write off around 7.5 billion pounds of debt remains under consideration. However, talks over the precise terms of such a restructuring have taken longer than expected. The proposed write down is seen as a key element in restoring the company’s balance sheet to a more sustainable position, but it has yet to be finalised.

Industry analysts say the interim funding reflects a desire among lenders to avoid a disorderly collapse that could disrupt services or trigger direct government intervention. At the same time, regulators are closely monitoring the situation to ensure that customers are protected and that essential infrastructure investment continues.

If a comprehensive restructuring deal cannot be agreed, Thames Water is widely expected to enter special administration. That process would temporarily place the company under government control while ensuring the continuity of water supply and wastewater treatment.

The unfolding situation at Thames Water has intensified scrutiny of financial structures across the privatised water sector. Policymakers have faced calls to strengthen oversight and reform governance frameworks after years of rising debt levels and environmental controversies.

For now, the additional funding provides short term stability as stakeholders attempt to reach a market led solution that would allow the company to continue operating without direct state control.