Latest News

UK Wage Growth Slows as Jobs Market Weakens Before Budget

Britain’s jobs market showed further signs of cooling toward the end of last year, with slower wage growth and falling payroll numbers offering potential relief on inflation pressures. Data released on Tuesday showed regular pay growth easing to 4.5 percent in the three months to November, while private sector pay excluding bonuses rose at its slowest pace since late 2020. The figures point to a more cautious labour market ahead of the autumn budget delivered by Chancellor Rachel Reeves, after months of subdued hiring and rising cost pressures for employers. Although the jobless rate remained steady at 5.1 percent, its highest level in nearly four years, economists said the overall picture suggests demand for labour is losing momentum as businesses rein in spending.

Payroll data highlighted the slowdown, with the number of people in payrolled employment falling by 43,000 in December, the largest monthly drop since 2020. Revised figures also showed a smaller but continued decline in November, underlining persistent weakness across the labour market. The data was published by the Office for National Statistics, which noted that some figures may still be subject to future revision. Despite the decline in employment, there were limited signs of stabilisation, including a modest rise in job vacancies, suggesting some employers remain willing to hire. Analysts said this balance points to a market that is softening but not yet entering a sharp downturn.

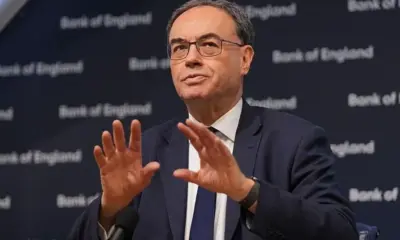

The weaker wage data will be closely watched by the Bank of England, which has been monitoring pay growth as a key indicator of inflation persistence. Markets expect the central bank to keep interest rates unchanged at its February meeting, with policymakers waiting for clearer evidence that price pressures are easing sustainably. Following the data release, the pound slipped against both the dollar and the euro, reflecting expectations that lower wage growth could allow for interest rate cuts later in the year. Economists said slowing pay increases could reduce inflation risks, though uncertainty remains over how quickly broader economic conditions will improve.

Outlook for the wider economy remains subdued, with international bodies forecasting modest growth for the UK this year. While recent data showed a brief pickup in activity in November, longer term expectations remain cautious as businesses adjust to higher borrowing costs and weaker demand. Bank of England Governor Andrew Bailey has said inflation is expected to fall sharply toward the central bank’s target in the coming months, provided wage pressures continue to ease. For now, the latest labour market figures suggest policymakers may have more room to consider easing, even as concerns persist about employment stability and household incomes.