Latest News

Oil climbs to two week high on Fed rate cut signals and supply concerns

Oil prices have risen to their highest level in two weeks as growing expectations of a US Federal Reserve rate cut, paired with renewed geopolitical uncertainty, helped push the market upward. Prices climbed around one percent on Friday, extending a steady rebound driven by hopes of stronger economic growth and fears of tightening supply.

Brent crude increased by 62 cents to $63.88 a barrel, while US West Texas Intermediate rose by 60 cents to $60.27. Analysts say the rise is partly fuelled by investor confidence that the Federal Reserve will cut interest rates next week. A reduction in borrowing costs typically stimulates economic activity, which in turn boosts demand for energy across industries and transportation.

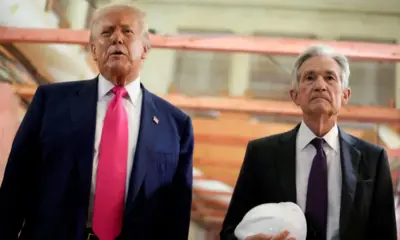

Traders have been closely watching the Fed’s messaging in recent days. Signs that policymakers are preparing to ease monetary policy have encouraged markets to shift back into commodities, including oil, after months of uncertainty. With investors expecting a clearer path to economic expansion, energy demand forecasts for the coming quarter have strengthened.

But economic optimism is not the only force behind the price climb. Geopolitical tensions are once again clouding the supply outlook, especially in Russia and Venezuela. Reports of stalled talks between Russia and Ukraine have raised concerns about disruptions to Russian output and export routes. At the same time Venezuela, which has struggled with production volatility for years, faces renewed instability that could restrict its flows to global markets.

Oil analysts say the combination of stronger demand expectations and potential supply constraints is a classic recipe for upward pressure on prices. “Markets are sensitive to any signal that supplies could tighten,” one US based energy strategist noted, adding that even small shifts in political negotiations can influence global pricing.

OPEC and its allies, collectively known as OPEC+, continue to maintain steady production levels. While no major output cuts or increases have been announced, geopolitical dynamics are playing a larger role in shaping sentiment. Several OPEC+ members are facing their own domestic challenges, leaving traders wary of unexpected supply disruptions.

In the US, the shale sector’s response will also be closely watched. While higher prices typically encourage an uptick in drilling, many producers have become more cautious in recent years, prioritising financial discipline over rapid expansion. This means that any increase in American output is likely to be gradual, keeping global supply relatively tight in the near term.

As markets move into the new week, all eyes will be on the Federal Reserve’s decision. A confirmed rate cut could add further momentum to oil’s upward trend, while any surprise deviation from expectations may cool prices quickly. For now the market is balancing between optimism and caution, with both economic policy and global politics shaping the path ahead.